Republican-led pushback in opposition to a controversial investing movement that critics decry for pushing “woke” political results in appears to be getting an impression.

U.S. sustainable resources, which use ESG requirements to consider investments or evaluate their societal affect, sank to their least expensive amount in far more than five decades by bleeding about $6 billion through the fourth quarter of 2022, in accordance to a report from fiscal services organization Morningstar.

ESG, small for environmental, social, and governance investing, is centered on the strategy that investors need to use these 3 wide groups when evaluating wherever to place their money, prioritizing progressive values and “social accountability” when producing monetary conclusions.

Sustainable money netted additional than $3 billion in 2022, boosting their property to $286 billion and carrying out much better for the yr than other U.S. cash. On the other hand, just about all the influx into ESG funds occurred for the duration of the initially quarter as demand for them has steadily declined more than the least two years.

President Joe Biden speaks at the University of Tampa on Feb. 9, 2023. (Joe Raedle/Getty Pictures)

ESG Financial investment RULE EMERGES AS Top ‘WOKE’ Target FOR REPUBLICANS BATTLING BIDEN

According to Morningstar, traders pulled their money for a range of good reasons, like large inflation, rising desire fees, chance of an impending economic downturn, weak industry returns, and “greenwashing” — the follow of providers deceptively promising to be environmentally friendly but not living up to their claims.

Another component was political backlash from ESG.

“In the United States, prominent politicians have spoken out against ESG investing, and some have taken steps to limit condition investment resources from executing small business with asset administrators based on perceptions of people managers’ ESG techniques,” the report said. “Even though both equally sustainable money and their standard counterparts observed outflows in the fourth quarter, the brief-time period withdrawals were more severe for sustainable funds.”

ESG has become a politically explosive difficulty above the past couple years.

The fireplace division takes advantage of a ladder truck to get rid of an environmental activists with the group Extinction Insurrection DC right after they scaled the Wilson Building as section of an Earth Working day rally versus fossil fuels on April 22, 2022, in Washington, DC. ((Image by Kevin Dietsch/Getty Visuals))

Residence GOP ANNOUNCES Aggressive, Initial-OF-ITS-Sort Hard work TO Battle ESG Motion

The concept underpinning ESG is that firms really should deemphasize their classic duty to increase worth for shareholders and rather make new commitments to different stakeholder teams, serving other passions and culture at substantial.

Numerous buyers now use ESG as a ranking technique to evaluate a company’s improvement of policies made to deal with weather alter, boost corporate board demographic variety and guidance a progressive “social justice” agenda, among other initiatives.

ESG has turn out to be significantly influential in modern years, evolving into a around $35 trillion marketplace, with that significantly in worldwide property being invested utilizing ESG concepts.

By 2025, world wide ESG property are predicted to exceed $53 trillion, representing additional than 1-3rd of the $140.5 trillion in projected whole belongings underneath management.

However, critics of what they explain as “company wokeness” have been mobilizing from the march of ESG advocates, arguing the economic movement is a way to press remaining-wing triggers through organization fairly than the legislature.

Sen. Joe Manchin, D-W.Va., is fulfilled by reporters at the Capitol in Washington, July 21, 2022. (AP Photo/J. Scott Applewhite, File)

Above 100 Teams Back again MANCHIN, GOP System TO BLOCK BIDEN’S ‘WOKE’ ESG INVESTING RULE

Republican leaders on the Household Economic Expert services Committee are making a activity pressure to coordinate their response to many proposals associated to ESG.

“Progressives are attempting to do with American enterprises what they now did to our general public schooling program — employing our establishments to force their significantly-left ideology on the American men and women,” Financial Expert services Committee Chairman Patrick McHenry, R-N.C., told Fox News Electronic previously this month. “Their hottest software in these endeavours is environmental, social, and governance proposals. This is why I am building a Republican ESG working team led by Oversight & Investigations Subcommittee Chair Monthly bill Huizenga.”

Sen. Joe Manchin, D-W.Va., not long ago joined Republican lawmakers in introducing laws intended to block a new rule implemented by the Biden administration rule that allows supervisors to aspect environmental and social difficulties into expenditure conclusions for the retirement money of far more than 152 million People in america.

At the condition degree, purple states have started utilizing actions to force back again on ESG insurance policies.

President Joe Biden in the South Courtroom Auditorium on the White Residence campus, Oct. 14, 2021. (AP Photo/Evan Vucci)

BIDEN WARNED ON ‘HEAVY-HANDED’ ESG Insurance policies HITTING Corporations, Family members

In Kentucky, for instance, Condition Treasurer Allison Ball previous thirty day period threatened to pull condition pension money from about a dozen firms — including financial institutions and big asset professionals these kinds of as BlackRock, Citigroup, and JPMorgan Chase, if they continued boycotting the oil and fuel marketplace.

All-around the exact same time, Florida prohibited point out-operate fund managers from having ESG factors into consideration when earning investments.

“Thanks to the management of Governor [Ron] DeSantis, the Florida cupboard reaffirmed right now that we will not want a single penny of our pounds going to woke cash,” Florida Main Economical Officer Jimmy Patronis said in a assertion at the time. “We need asset supervisors to be laser focused on returns and practically nothing additional. Florida’s not heading to subsidize the actions of a bunch of Leftist ideologues who dislike America we’re not likely to allow a bunch of prosperous people in Manhattan or Europe try to circumvent our democracy.”

Critics argue companies are violating their fiduciary duties to their shareholders by sacrificing the primary monetary aims of the corporation for a “woke agenda” and not carrying out what the shareholders want.

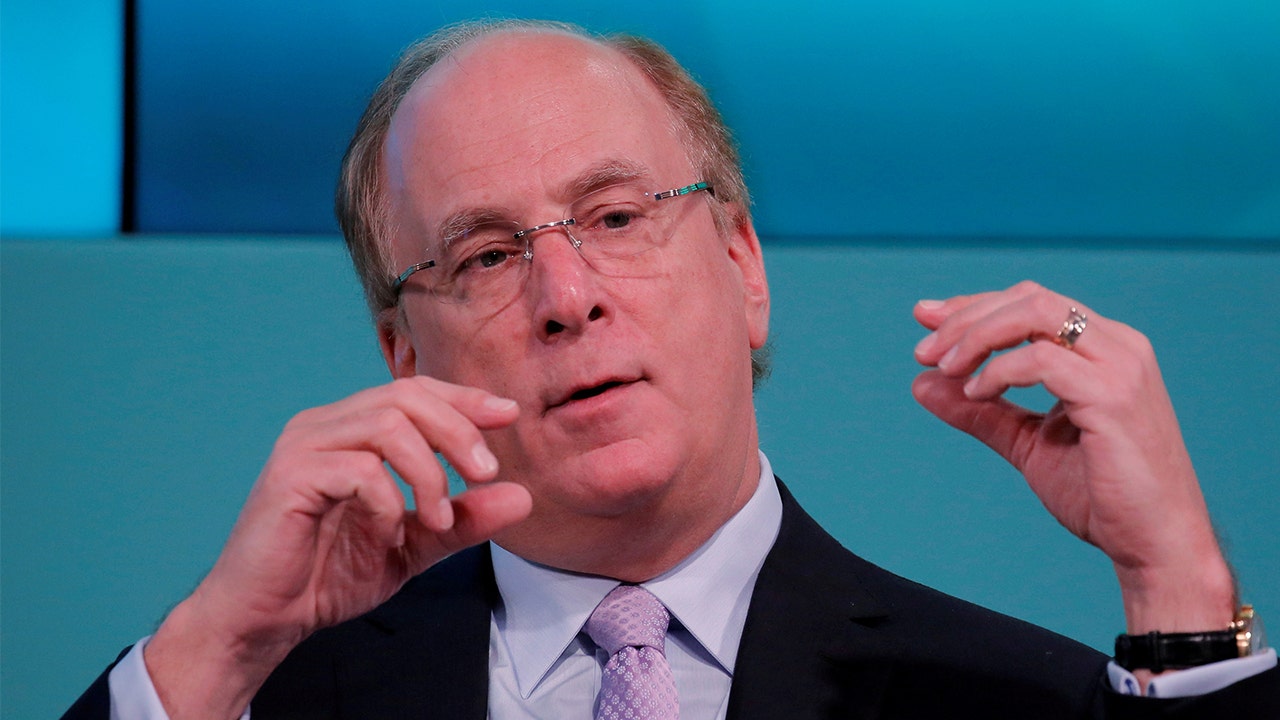

Larry Fink, main govt officer of BlackRock, usually takes portion in the Yahoo Finance All Marketplaces Summit in New York, Feb. 8, 2017. (REUTERS/Lucas Jackson/File Photograph)

Corporate WOKENESS: Major TECH, Key Banks RATED ‘HIGH RISK’ OF CANCELING Folks, ORGS FOR IDEOLOGICAL Reasons

BlackRock CEO Larry Fink, one particular of corporate America’s largest promoters of ESG, responded to these criticism in a letter he penned to CEOs very last calendar year.

The ESG movement “is not about politics. It is not a social or ideological agenda. It is not ‘woke,'” wrote Fink. “It is capitalism, driven by mutually effective associations among you and the staff, clients, suppliers, and communities your company relies on to prosper … Make no miscalculation, the good pursuit of gain is however what animates marketplaces and very long-phrase profitability is the measure by which marketplaces will in the end establish your firm’s success.”

In December, Patronis declared that Florida would dismiss BlackRock as supervisor of about $600 million in brief-expression overnight investments and an added $1.4 billion in extended-phrase securities.

Two months before, Missouri pulled $500 million in condition pension cash from BlackRock. Meanwhile, Louisiana taken off $794 million from BlackRock money. Equally states mentioned that BlackRock’s ESG commitments have been the cause for their divestments.

In Texas, Point out Comptroller Glenn Hegar declared in August that BlackRock and other asset managers were boycotting the Texas fossil gas sector, prompting the state’s pension fund to divest from the companies.

Click on Listed here TO GET THE FOX News APP

These kinds of endeavours may well be bearing fruit. According to Morningstar, sustainable resources lose $2.4 billion all through the fourth quarter, their steepest outflows in additional than three many years. In the meantime, lively sustainable cash bled $3.8 billion, triggering these funds to land in destructive territory for 2022 with a $1.3 billion web outflow.

Overall, 2022 was a terrible calendar year for U.S. money. All mutual and trade-traded resources suffered far more than $370 billion in withdrawals, marking the to start with calendar year of web outflows due to the fact Morningstar started monitoring data in 1993.